Stamp duty and Registration Charges of Shimla

- 13th Jul 2021

- 1816

- 0

Never miss any update

Join our WhatsApp Channel

Every state collects the stamp duty charges every time the property is transferred from one person to another. Stamp duties are imposed on an area or transaction value that is higher at the current circular rate. Section 80 C of the 1961 Income Tax Act allows a homebuyer to claim up to Rs 1.5 lakh a deduction from the stamp duty and registration fee. In addition to the stamp fee on the basis of guidance or market value, the registration fee is payable, whichever is lower.

Stamp duty Charges in Shimla

| Gender | Stamp Duty Charges |

| Male | 6% |

| Female | 4% |

| Co-Ownership | 5% |

To promote homeownership among women in the state, the Himachal Pradesh government offers rebates, if the property is registered solely in the name of a woman. This rebate is also applicable if the woman happens to be a joint owner of the property.

Stamp duty on major documents

| Document | Stamp duty |

| Agreement | Rs 50 |

| Will | Rs 200 |

| Lease | Rs 200 |

| General power of attorney | Rs 100-200 |

| Gift Deed | 4%-6% of the deed value |

| Conveyance | 4%-6% of the deed value |

| Special power of attorney | Rs 100 |

| Affidavit | Rs 10 |

Calculation of stamp duty and charges in Shimla

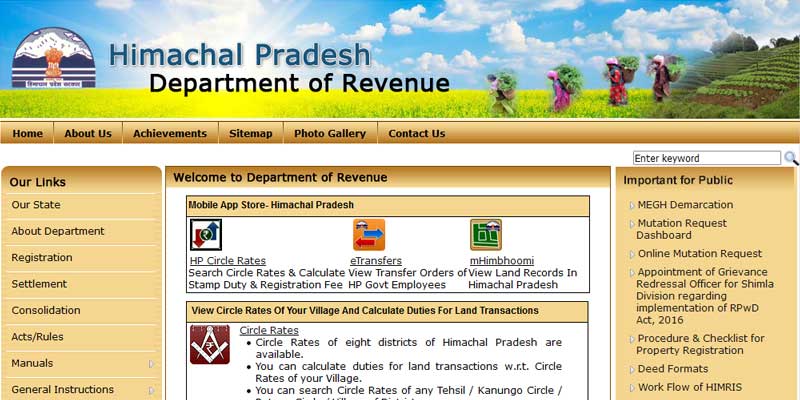

The payable stamp duty can be made on the official website of the Himachal Pradesh Revenue Department using the online stamp duty calculator.

1. To view the stamp tax calculator, visit the Himachal Pradesh revenue portal.

2. Choose the appropriate option from the drop to down list and click on the 'Select deed type' tab.

3. Please enter on the web page the details like the patwar cycle, tehsil, Kanoongo circle, area, village type, area type, and financial year.

4. Enter the captcha code and click on the continue button when filling out the details.

5. It will forward you to a new page to select the category type – I, II, and III. The circular rate for the above categories will differ.

6. The market value would be calculated after giving the details of the area in which the transaction was held (Bigha-Biswa-Biswansi).

7. The applicant shall be required to perform the stamp payment percentage (male and female). The actual stamp fee is calculated on the basis of the shared information.

8. Now provide the amount of consideration/transaction in the form of duty that is higher depending upon the current market value.

The stamp duty is paid when you submit an online application and is automatically calculated after all details are provided.

In conclusion, the stamp duty and registration fees in Shimla are easy to calculate and pay. You can reach near Sugam Centers or the office of the sub-registrar and ask a property lawyer to help you with the procedure.

Registration charges in Shimla

| Gender | Stamp Duty Charges |

| Male | 2%, up to a maximum of Rs 25,000 |

| Female | 2%, up to a maximum of Rs 15,000 |

| Co-Ownership | 2%, up to a maximum of Rs 15,000 |

Admin

Admin

Comments

No comments yet.

Add Your Comment

Thank you, for commenting !!

Your comment is under moderation...

Keep reading blogs